In this article I will talk about the Best Crypto Sentiment Indicators, and how they enable traders to decipher the psychology of the market.

These tools assess social networks, search volume, on-chain data, funding rates, and whale activity to gauge the temperature of the market.

Employing these tools allows traders to predict price movements, identify trends in the early stages, and make rational decisions within one of the most volatile markets in the world- cryptocurrency.

Table of Contents

What is Crypto Sentiment Indicators?

Sentiment indicators are tools that assess the feelings and attitudes of those involved in the cryptocurrency markets. They evaluate the social media and news discourse, trading volume data, and public discussions to estimate bullish and bearish trading sentiments.

The Fear and Greed Index, social media audience sentiment, and some on-chain metrics are classic illustrations of sentiment indicators and the predictive modeling of price change trends and market direction and movement.

Crypto sentiment indicators allow market sentiment to be gauged and aid in the identification of phases of extreme enthusiasm and of excessive dread, leading to the optimization of trade execution on the and the volatile crypto market improvement of risk.

How Too Choose Best Crypto Sentiment Indicators

Data Source Reliability: Opt for an indicator which uses verified and transparent information from reputable sources.

Real-Time Updates: Make certain the tool provides live or frequently refreshed updates of market data.

Comprehensive Coverage: Find apps that provide analysis of various social media platforms and combine that data with news and on-chain metrics.

Ease of Interpretation: Choose tools that have simple graphics or an easily understandable rating system.

Historical Accuracy: Look at historical data to see if the tool has successfully indicated trends in the crypto market.

Customization Options: Use tools which let you set parameters for individual coins and within defined time intervals.

Integration Capability: Opt for sentiment analysis tools that work with your preferred trading platforms or trading bots.

Key Point & Best Crypto Sentiment Indicators List

| Sentiment Indicator | Key Point |

|---|---|

| Social Media Sentiment | Measures trader emotions and opinions from platforms like Twitter and Reddit. |

| Google Trends | Tracks search interest for crypto-related keywords to gauge public attention. |

| On-Chain Metrics | Analyzes blockchain data such as wallet activity and transaction volume. |

| Funding Rates | Shows trader bias in futures markets—positive rates indicate bullish sentiment. |

| Open Interest | Reflects total active derivative contracts, signaling market participation. |

| Volume Sentiment | Compares buy vs. sell volumes to reveal market strength or weakness. |

| Whale Alert | Tracks large transactions from major wallets to detect institutional moves. |

| Sentiment Heatmaps | Visualize aggregated market mood using color-coded sentiment indicators. |

1. Social Media Sentiment

Social media sentiment is one of the best crypto sentiment indicators because it reflects, in real time, the feelings, opinions, and responses of millions of traders on X (Twitter), Reddit, and Telegram.

Social media sentiment is distinct from other market indicators because it gauges the collective psychology of the crypto community, picking up signals of excitement, panic, or assurance before the market makes any price changes.

This indicator is able, in real time, to identify changes in investor sentiment using the combination of sentiment analysis, engagement metrics, and activity of various crypto influencers.

Social trend analytics enable traders to predict possible trend reversals even before the crypto market undergoes major shifts, reinforcing the value of Social Media Sentiment as a crypto market indicator.

Social Media Sentiment Features

- Real-Time Insights: Tracks Twitter, Reddit, and Telegram to analyze sentiment and perceive shifts instantly.

- Sentiment Scoring: Positive, neutral, and negative classifiers score social media posts.

- Market Influence Detection: Finds conversations and community posts that could influence and anticipate market behavior.

2. Google Trends

One of the Best Crypto Sentiment Indicators is Google Trends. It demonstrates the interest and awareness levels through keyword searches.

Interest and anxiety in the market can be determined by how frequently “Bitcoin,” “Ethereum,” and “crypto crash” are talked about. Retail investors display excitement or fear before dramatic price changes, and search volume levels increase during these periods.

Google Trends’ value lies in tracking organic user behavior and not in speculative and volatile data. Google Trends is one of the most reliable indicators of market psychology, and it helps investors anticipate driven global attention and sentiment.

Google Trends Features

- Search Volume Tracking: Checks how many people search crypto to see which currencies are becoming popular and how fast.

- Trend Analysis: Identifies critical moments when the value of crypto changes a lot.

- Geographical Insights: Identifies ‘search by volume’ to know the sentiment of a local market.

3. On-Chain Metrics

On-Chain Metrics are one of the Best Indicators of Crypto Sentiment since they track activity on the blockchain and assess the open and verifiable data surrounding a market.

Activity on wallets, transfer volume, and token holdings provide crucial information about the direction and fluidity of assets, which indicates confident buying or selling and market sentiment if the movement of assets is cautious.

Contrary to price indicators which could be based on speculation, on-chain metrics provide observable and verifiable evidence of market activity which makes them dependable indicators of future price movements.

It is also the only source of data that provides insight into the behavior of retail and institutional market participants or whales. Analysts who interpret these metrics are able to predict with a high degree of accuracy whether a market is in the process of reversing or a consolidation phase.

On-Chain Metrics Features

- Network Activity: Tracks the number of wallets, transactions, and active addresses to quantify network activity.

- Liquidity Insights: Measures flow of tokens between wallets and blockchain.

- Investor Behavior: Tracks large moves to gain sentiment on crypto market and the expected direction of the current trend.

4. Funding Rates

Funding rates are some of the Best Crypto Sentiment Indicators as they show the trader sentiment of the perpetual futures markets.

A positive funding rate means that the longs are dominant; this shows bullish sentiment. A negative funding rate means that the shorts are the dominant position; this reflects a bearish mood.

What makes this uniquely powerful is its ability to show when a market is overheated and when there is excessive leverage. It helps predict potential corrections before they happen.

Analyzing funding rates across major exchanges helps assess crowd behavior and market psychology. This makes funding rates critical in determining when to enter or exit and in adjusting exposure to risk in the highly volatile cryptocurrency markets.

Funding Rates Features

- Derivative Market Sentiment: Informs on traders positions concerning to crypto and whether they are expecting a rise or decline.

- Leverage Insights: Convenience or cost of borrowing capital to organic or fund your wager indicates sentiment of market participants.

- Market Trend Signals: Extreme and turbulent ranges of a market activity can indicate trend reversals and sentiment shifts.

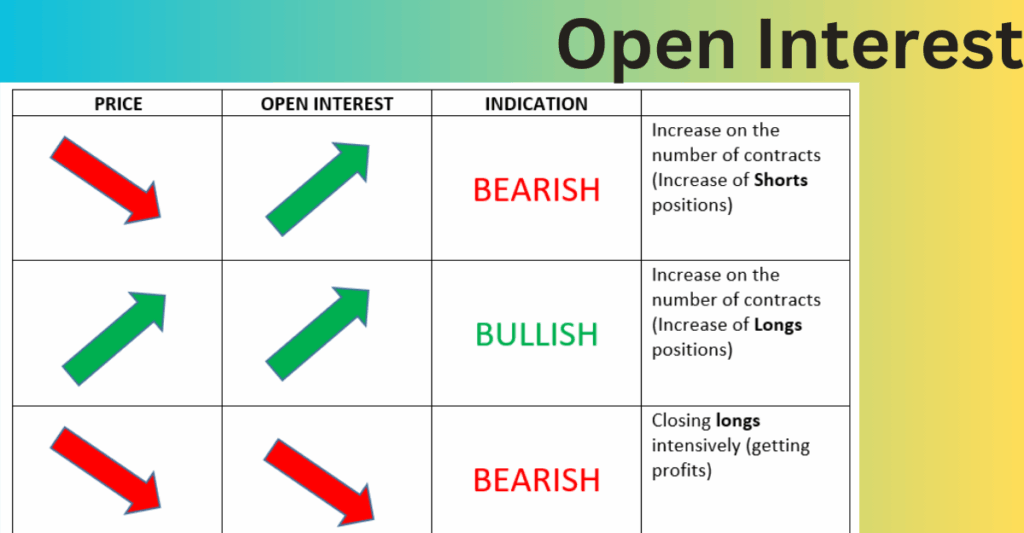

5. Open Interest

Open Interest is regarded as one of the best indicators of market sentiment in the crypto space as it captures the total active derivative contracts and demonstrates how many players are in the market and how committed they are.

Increasing open interest when prices are up signifies strong bullish sentiment, and increasing open interest when prices are down shows bearish pressure.

Its unique edge is that it shows the degree of trader activity which has a great impact on the likelihood of continuation or reversal of a trend, rather than simply the price.

Movements in open interest across the futures and options market allows one to assess market sentiment, anticipate changes in volatility, and make decisions, making it a fundamental aspect of most advanced crypto trading strategies.

Open Interest Features

- Volume of Contracts: This is the total number of open contracts, both futures and options, at any given time.

- Liquidity & Strength: Assesses if a trend is backed by sufficient participation or if it is evaporating.

- Sentiment Shifts: Abrupt changes can signify a loss or gain of conviction in the market.

6. Volume Sentiment

Volume Sentiment is considered one of the Best Crypto Sentiment Indicators because it measures the proportion of buying and selling activities and uncovers the real strength of ongoing trends in the market. The market ‘s confidence and attitudes become bullish when buying volumes are high.

On the other hand, the market ‘s confidence and attitudes become bearish and the trends dip when selling volumes are high. Its unique strength is that it shows not only the direction of price movement, but also the conviction behind the movement.

This allows for the identification of meaningless price movement versus sustained trends. The trait makes Volume Sentiment one of the most valuable market indicators for predicting the price ‘s time and direction, thus enabling confident and sustained decision-making, and forming the basis for the most important crypto trading strategies.

Volume Sentiment Features

- Trading Activity: Measures the volume of trades bought and sold on an exchange.

- Trend Confirmation: An increase in buying volume is indicative of bullish trend and an increase in selling volume is indicative of bearish trend.

- Market Pressure Insights: Will indicate overbought or oversold conditions.

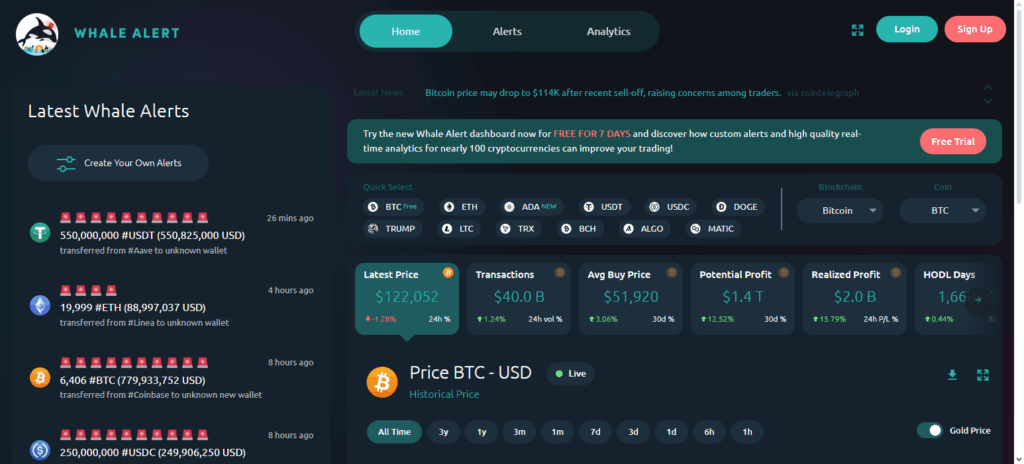

7. Whale Alert

Whale Alert is amongst the Best Crypto Sentiment Indicators as it observes large transactions made on the blockchain by large holders referred to as “whales.”

Such large transfers can indicate upcoming market movements and possible sell-offs, accumulations, or changes in an investor’s game plan.

Whale Alert’s distinct value proposition is the provision of early warnings on institutional activity which is later followed by retail traders.

By actively watching these players, investors can predict volatility and fine-tune their positions accordingly. By balancing transparency with predictive power, Whale Alert is an indispensable tool in gauging the crypto market sentiment with an accurate understanding of sentiment.

Whale Alert Features

- Large Transactions Tracking: Covers large movements of crypto for any wallet or exchange.

- Market Impact Signals: Spots large movements that could potentially impact the price.

- Real-Time Notifications: Send alerts to me to ensure that the decision can be made quick for the traders.

8. Sentiment Heatmaps

Sentiment Heatmaps are among the Best Crypto Sentiment Indicators because they illustrate the mood of the market across various cryptocurrencies and different time frames.

Bullish, bearish, and neutral sentiments are indicated with different colors, showing trends and comparing emotions of the market almost instantly.

Aggregating data from social media, trading volumes, and on-chain metrics into a cohesive heatmap generated the unique advantage of helping market participants in pattern recognition, overbought and oversold situation identification, and confidence in decision-making.

Sentiment Heatmaps facilitate the market and pattern sentiment analysis for real-time trading strategy optimization.

Sentiment Heatmaps Features

- Visual Market Overview: Sentiment analysis using heatmaps which illustrate bullish or bearish sentiment.

- Quick Comparison: Helps identify which coins are bull or bear just by a glance.

- Trend Analysis: Identifying and tracking movements in sentiment bullish or bearish.

Pros & Cons Crypto Sentiment Indicators

Pros

- Insider Nuggets: Pick potential bullish/bearish trends before any price action occurs.

- Psychology Elements: Captures investor psychology and helps recognize emotional states relating to the market.

- Volatility Prediction: Predict market fallout and impulsive behavior to improve risk.

- Evidence-based Trading: Crypto and social metrics combined to inform strategy.

- Validation: Acts as a confirmation of other technical or fundamental analysis.

Cons:

- Noise and Misinformation: Social media and short-term hype attracts noise and hence, misleading information.

- Certain Lagging Indicators: Some indicators are slow and hence, reduce real-time relevancy.

- Complex Evaluation: The need and ability to zero in on and distill many indicators is gained through experience.

- Not Factoring Other Variables: Reliance on just one factor will inevitably lead bad decisions.

- Sentiment and Price Trends Correlation: Many sentiment periods and trends do not correlate with predicted price action.

Conclusion

To sum up, Crypto Sentiment Indicators are important for identifying the psychology of the market which then helps in predicting price changes.

Sentiment on social media, Google Trends, on-chain metrics, funding rates, open interest, volume sentiment, activity of whales, and sentiment heatmaps reveal whether the market players are retail or institutional.

Although, there is no ‘one and done’ indicator, using several sentiment indicators in conjunction with technical and fundamental analysis can improve the outcome of a trade, mitigate risks, and spot potential opportunities.

Anyone looking to gain the upper hand in the unpredictable crypto market must utilize top sentiment indicators to control and track market activity.

FAQ

Can sentiment indicators predict price movements accurately?

While not 100% accurate, they give early warnings and trend confirmations when used alongside technical and fundamental analysis.

Which are the most reliable crypto sentiment indicators?

Popular indicators include Social Media Sentiment, Google Trends, On-Chain Metrics, Funding Rates, Open Interest, Volume Sentiment, Whale Alerts, and Sentiment Heatmaps.

How should beginners use crypto sentiment indicators?

Start by tracking one or two indicators, observe market behavior, and gradually combine multiple metrics for better insights and informed trading decisions.

What are crypto sentiment indicators?

Crypto sentiment indicators measure the mood and emotions of investors in the cryptocurrency market, helping traders anticipate bullish or bearish trends.

Why are sentiment indicators important in crypto trading?

They provide insights into market psychology, detect hype or fear, and help traders make data-driven decisions, improving risk management and timing.